Since the shares of the Company are listed on the STAR segment of the Italian Stock Exchange organised and managed by Borsa Italiana S.p.A., the Company, in accordance with article 2.2.3, paragraph 3, letter k) of the rules on markets organised and managed by Borsa Italiana, adopted and implemented the organisation, management and control model provided under article 6 of Legislative Decree no. 231 of 8 June 2001 (the “Model 231”), a consistent system of procedures, rules and controls aimed at preventing and/or reducing the risk of commission of those criminal offences provided for by the Legislative Decree No. 231/2001.

The said Decree introduced the administrative liability of legal persons and their bodies for specific types of criminal offences provided under the criminal code (including offences against the public administration, corporate offences, market abuse, etc.) committed and pursued in Italy by parties who act in representative, administrative or management capacities of the company or one of its administrative areas with financial and functional autonomy or by members of their staff in the interest of and/or to the benefit of the company.

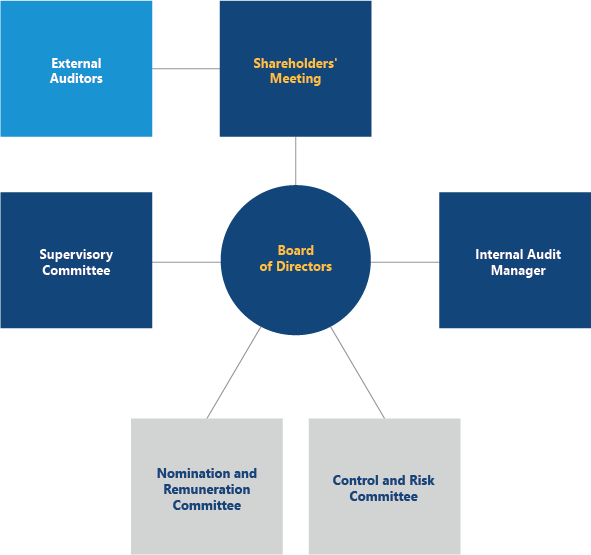

However, while introducing this administrative liability regime, the Decree also provided for a specific type of release from responsibility in case the company can prove that it adopted and efficiently implemented an organisation, management and control model that could prevent said offences, and that a specific body within the entity was given responsibility for supervision of the functioning, adequacy and effectiveness of the said model and its updating (the Supervisory Committee ), and was given independent powers of initiative and control.

The Company initially adopted the Model 231 on 12 March 2008 in order to prevent the commission of offences established by Legislative Decree 231/2001. The most recent updates and restructuring to the Model 231 were made by decision dated 29 July 2021. Subsequently, the company carried out a further risk assessment following changes that had occurred with respect to the reference regulatory framework and deemed it unnecessary to update the Special Parts of the 231 Model but instead approved an updated version of the General Part of the Model as at 10 November 2022 which takes into consideration the latter assessment.

***

The lastly updated General Part of the Model 231 is available in this section.