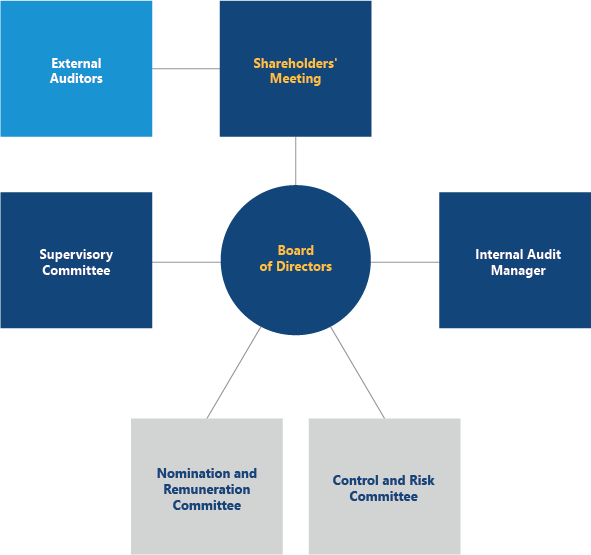

DIS Corporate Governance

The corporate governance system adopted by the Company complies with the regulations and applicable Italian and Luxembourg law, the articles of association and the corporate governance code promoted by Borsa Italiana S.p.A..

Generally, the corporate governance system of the Company is based on the fundamental role of the board of directors, the transparency of company decision-making processes, an efficient system of internal control, and the codes, principles, rules and procedures that govern and regulate the activities of all the organisational and operating facilities of the Company.

The Company’s reports on the corporate governance system published every year gives a detailed description of: the governance structures, company organisation, information on the ownership structures, rules, obligations, standards of business conduct, control systems, processing company information and shareholder relations.

***

Both the last corporate governance report and the archive of the annual reports on the corporate governance system and the ownership structures are available in this section.